When I was young, my family used to enjoy going to Wendt Beach in Angola, NY. Despite its rocky shore (which made us wince due to our tender feet), the waves never disappointed. One day, I followed my older sister into the deeper waters where she was hanging out with friends. I did not know how to swim and soon the water was up to my nose. Then, I experienced an undertow which pulled me slowly away from the group… but, thankfully, closer to shore which allowed me to get out of the water.

Managing money seems to be a skill involving math, reason, and a fair amount of discipline (i.e. swimming). While that is true, what most people ignore or fight against are the emotional influences that affect our financial decisions, that “pull” us is directions we didn’t plan to go. “Undertow” can also mean a tendency to think or feel in a way that seems contrary to what is the strongest or most apparent. Our emotions are the undertow in our financial decisions, and that’s not necessarily a bad thing.

Think of any major financial decision you’ve made and how the family or friends around you at that time helped or hindered your efforts. Think of how their opinions moved you towards or away from a choice.

How You Feel and How You Spend

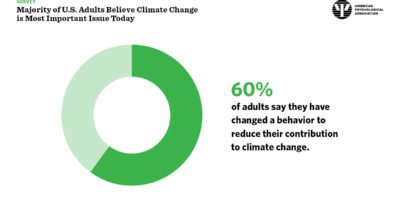

There’s no denying the (full range of) emotions we experience when making financial decisions, be they small or large. A recent study cited that 77% of Americans feel anxious about their financial situation. Rather than try to avoid their emotions, I encourage people to acknowledge them and use the best emotions (love, hope, care) to direct them towards more healthy financial decisions that align with their deepest values and support the goals they have for their lives.

How can you use your emotions to move you towards financial well-being?

For example, I know several people who love to bargain shop, even sometimes for items they don’t necessarily need at that time. Emotionally, they feel excited when they find an item on sale, like they have an opportunity, and they don’t want to miss it. We redirect that same emotion into using their resources to find other opportunities (such as saving and investing) that may help strengthen their financial situation rather than weaken it.

Amy Jo Lauber, CFP®, Lauber Financial Planning